Raymond James administers your accounts through Pershing Securities Limited who act as custodian for your investments.

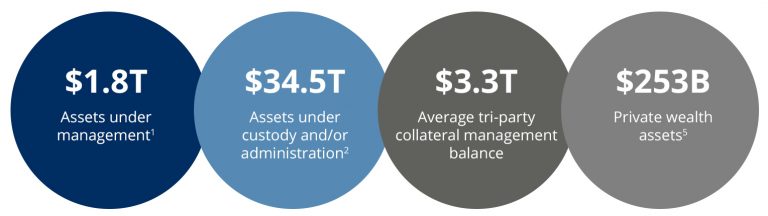

Pershing is part of the Bank of New York Mellon Corporation, one of the world’s strongest financial institutions, with $45.7 trillion in client assets under custody and administration.

In compliance with the Financial Conduct Authority’s Client Asset Rules, your investments are held on trust in accounts segregated from Pershing’s own assets. In the unlikely event of default by Pershing, your assets would be allocated to you as the beneficial owner.

In addition, the FCA’s Client Asset Rules require Pershing to perform regular checks to verify that investor assets held in trust are accurately recorded.

In the unlikely event that Pershing had failed to properly apply the FCA’s Client Asset Rules and had also defaulted on its obligations, eligible investors would be able to make a claim to the Financial Services Compensation Scheme (FSCS) for any assets lost by Pershing. The FSCS provides cover up to £85,000 per eligible claimant for investments.

Pershing also has additional insurance policies in force to protect against financial loss caused by events such as forgery, fraudulent alteration and computer crime.

*As at 30 September 2023

Your cash is held in the Pershing Cash Account

Pershing holds your cash balances as Client Money, which means that funds within your Cash Account are held by Pershing acting as trustee. It is segregated from Pershing’s own corporate assets and held in designated trust accounts at one or more banks.

Should any of the banks that Pershing uses fail, investor protection provided by the FSCS applies. The limit is currently £85,000 per eligible claimant per FCA authorised financial institution.

BNY Mellon’s Global Assets

*As of 30 June 2019

Pershing Securities Limited is a member of the London Stock Exchange and is authorised and regulated by the Financial Conduct Authority.